When setting up or restructuring a business, two documents often come into play: the Articles of Association and the Shareholder Agreement. Though they may appear similar, they serve different purposes and address different needs. Here’s why it’s crucial to have—and understand—both.

What Are Articles of Association?

-

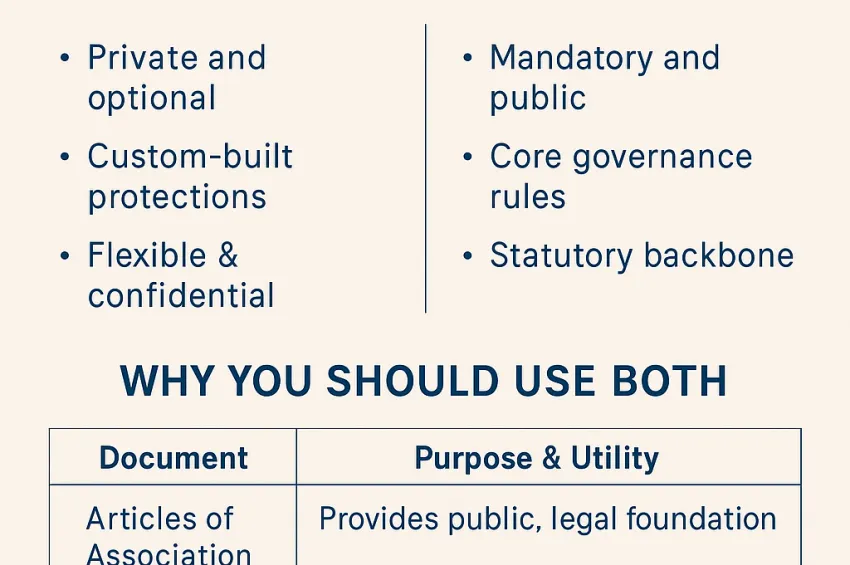

Mandatory and public: Every UK company must have Articles of Association at incorporation, filed with Companies House and available to the public. They serve as the company’s constitution, outlining governance rules under the Companies Act 2006.

-

Core functions: Articles regulate essential aspects like director powers and appointments, decision-making procedures, share issuance and transfer restrictions, voting protocols, dividend rights, and quorum requirements.

-

Statutory backbone: They must align with the law and are enforceable as a matter of corporate law.

What Is a Shareholder Agreement?

-

Private and optional: In contrast, a Shareholder Agreement is a confidential contract between shareholders and optionally the company. It is not filed with any public registry.

-

Custom-built protections: It can govern rights and obligations that the Articles don’t cover—or don’t cover in enough detail—such as exit strategies, dividend policy, tag-along and drag-along rights, dispute resolution, dilution control, and share transfer rules.

-

Flexibility & confidentiality: Unlike Articles, shareholder agreements can be tailored precisely and changed without public disclosure.

Why You Should Use Both

| Document | Purpose & Utility |

|---|---|

| Articles of Association | Provides the public, legal foundation for company governance. Required under the Companies Act and governs fundamental operations. |

| Shareholder Agreement | Offers flexible, private safeguards tailored to shareholders’ specific needs—especially vital for closely-held companies and startups. |

A Shareholder Agreement can:

-

Supplement Articles by filling gaps (e.g., exit clauses for death or sale)

-

Expand provisions where Articles are too limited (e.g., specifying drag-along rights)

-

Override Articles when drafted with a supremacy clause—though this requires careful legal framing

As one expert puts it:

“It is entirely possible to have the articles without a shareholder agreement but not vice versa.”

Risks of Having Just One Document

-

Articles alone: May expose you to unexpected governance gaps—vulnerable to deadlocks, disputes, or complications at exit.

-

Shareholder Agreement alone: Cannot replace the statutory framework—Articles are required by law.

-

Conflicts between them: An inconsistent Shareholder Agreement can’t bind third parties or override statutory Articles—conflicts can lead to legal confusion.

Practical Scenario: Why Dual Documents Matter

Consider a startup with three co-founders planning for future investment and potential disputes:

-

Articles: Define board structure, director voting percentages, share classes, and quorum thresholds.

-

Shareholder Agreement: Defines buyout triggers if a founder leaves, includes drag-along/tag-along protections for investors, sets dispute resolution mechanisms, and defines how future financing affects equity.

This dual structure offers both legal integrity and operational flexibility.

Final Thoughts

Articles of Association and Shareholder Agreements each play a unique yet complementary role in company governance. For most closely-held businesses and startups—even those that start simply with friends or family—having both documents is not only prudent but protective.

Need help drafting or reviewing your Articles or Shareholder Agreement to ensure they align and protect your interests? I’m here to provide expert guidance, tailored to your business needs.