Stepping into a directorship in 2025 comes with evolving responsibilities—and increasing legal exposure. Here’s what you need to know to protect yourself while steering your company forward.

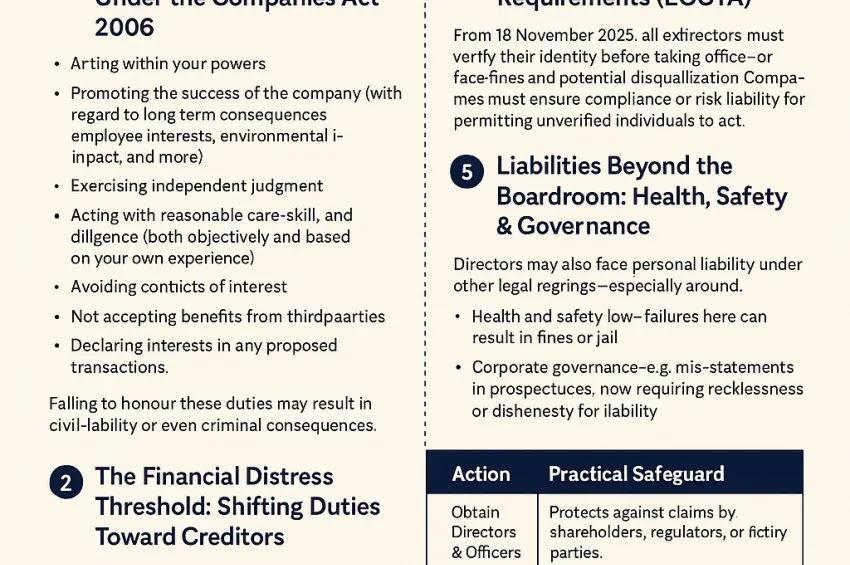

1. Core Statutory Duties Under the Companies Act 2006

As a director, you owe seven binding duties under Sections 171–177 of the Companies Act. These include:

-

Acting within your powers

-

Promoting the success of the company (with regard to long-term consequences, employee interests, environmental impact, and more)

-

Exercising independent judgment

-

Acting with reasonable care, skill, and diligence (both objectively and based on your own experience)

-

Avoiding conflicts of interest

-

Not accepting benefits from third parties

-

Declaring interests in any proposed transactions

Failing to honour these duties may result in civil liability or even criminal consequences.

2. The Financial Distress Threshold: Shifting Duties Toward Creditors

In times of solvency trouble, your duties shift. Under Insolvency Act 1986, directors must:

-

Avoid wrongful trading—continuing to trade when insolvency is inevitable

-

Avoid fraudulent trading—dishonestly defrauding creditors or the company

Breach may expose you to personal contributions toward company debts—or imprisonment in severe cases.

3. New Identity Verification Requirements (ECCTA)

The Economic Crime and Corporate Transparency Act 2023 (ECCTA) adds a compliance layer. From 18 November 2025, all directors must verify their identity before taking office—or face fines and potential disqualification. Companies must ensure compliance or risk liability for permitting unverified individuals to act.

4. Expanding Corporate Criminal Liability

New developments under the Crime and Policing Bill 2025 could make companies—and senior staff—criminally liable for actions by senior managers, even beyond economic crimes. Anyone classified as a “senior manager,” acting within the scope of their authority, can cause the company to face prosecution.

5. Liabilities Beyond the Boardroom: Health, Safety & Governance

Directors may also face personal liability under other legal regimes—especially around:

-

Health and safety law—failures here can result in fines or jail.

-

Corporate governance—e.g. mis‐statements in prospectuses, now requiring recklessness or dishonesty for liability.

6. Practical Steps to Shield Personal Exposure

| Action | Practical Safeguard |

|---|---|

| Obtain Director & Officers (D&O) Insurance | Protects against claims by shareholders, regulators, or third parties. |

| Consider a Deed of Indemnity | Adds an extra layer of protection for covered liabilities. |

| Keep robust board minutes and records | Evidence of due diligence can be vital in disputes or investigations. |

| Monitor solvency and cash flow | Transparency and early engagement with advisors can demonstrate duty of care in financial distress. |

| Complete ID verification promptly | Avoid breaching ECCTA requirements. |

| Strengthen compliance frameworks | Crucial under expanding criminal liability regimes. |

Final Thoughts

Directorship in 2025 means more than strategic decisions—it demands legal vigilance across financial, operational, and regulatory domains. Non-compliance can result in personal liability, fines, or even disqualification.

Need help reviewing your duties, securing insurance, or bolstering governance? I’m here to help you safely navigate these evolving responsibilities.