The UK is one of the world’s most business-friendly environments, offering low bureaucracy, a clear legal framework, and a thriving market. Whether you’re a UK resident or an overseas entrepreneur, opening a company here can be a straightforward process if you know the steps.

In this guide, we’ll walk you through the key stages of setting up a company in the UK, the requirements you’ll need to meet, and some important tips to help you get started.

1. Choose the Right Business Structure

Before registering your business, decide on the most suitable structure. The most common options in the UK are:

- Sole Trader – Ideal for freelancers or one-person businesses. Simple to set up, but you are personally liable for debts.

- Partnership – Two or more people share the responsibilities and profits.

- Limited Liability Partnership (LLP) – Offers flexibility with limited liability protection.

- Private Limited Company (Ltd) – Separate legal identity from its owners, offering protection for personal assets. This is the most popular choice for both UK and foreign entrepreneurs.

2. Pick a Unique Company Name

Your company name must be unique and cannot be identical or too similar to an existing registered name. You can check name availability using the Companies House name availability checker.

Tip: Avoid sensitive or restricted words unless you have permission to use them.

3. Register Your Company with Companies House

If you are setting up a Limited Company or an LLP, you must register with Companies House. The process can be completed online, often within 24 hours.

You will need:

- Company name

- Registered office address (must be in the UK)

- At least one director (for Ltd) or one member (for LLP)

- Details of company shares and shareholders

- Memorandum and Articles of Association (for Ltd companies)

4. Register for Taxes

All businesses in the UK must register with HM Revenue & Customs (HMRC) for tax purposes. This may include:

- Corporation Tax – for limited companies (register within 3 months of starting business)

- Self Assessment – for sole traders or partnerships

- VAT – if your annual turnover exceeds £90,000 (2024 threshold)

5. Set Up a Business Bank Account

While sole traders can use a personal account, a limited company must have a separate business bank account. Many UK banks offer tailored business banking packages, and some online-only banks provide quick, paperless account setup.

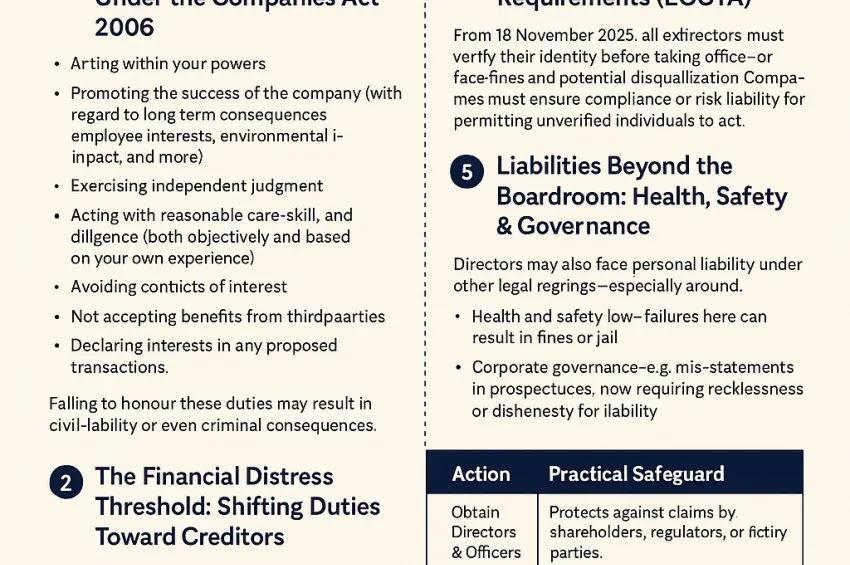

6. Understand Your Ongoing Obligations

Running a company in the UK involves ongoing compliance:

- Filing annual accounts with Companies House

- Submitting a confirmation statement

- Filing tax returns and paying the right amount of tax on time

- Keeping accurate accounting records

7. Additional Considerations for Overseas Entrepreneurs

Non-UK residents can open a UK company without living in the country. However, you will need:

- A UK registered office address

- A local accountant or agent to help with compliance

- An understanding of UK tax laws and double taxation treaties

If you plan to move to the UK to run your business, you may also need a suitable business visa, such as the Innovator Founder visa.

Setting up a company in the UK is a relatively fast and cost-effective process. With the right planning and advice, you can launch your business in one of the world’s most trusted and dynamic economies.

If you need help registering your company, managing compliance, or navigating UK business immigration rules, our team can guide you through every step — from formation to full operational setup.